INSURANCE

SOLUTIONS

Insurance is inundated with highly complex processes. REQUORDIT can help you maximize the potential of your team by helping automate many of the repetitive manual tasks across the insurance organization.

INSURANCE

SOLUTIONS

Forget highly manual and paper-intensive processes. At REQUORDIT we can help you maximize the potential of your insurance department by helping your team automate repetitive manual tasks.

Insurance is a paper heavy process

Hundreds of documents and thousands of data points must be collected every time a new subscription has to be evaluated, a policyholder makes a change or an insured files claim. In an industry where speed equals success, insurers are looking for technology to make the process more efficient, cost effective, and compliant.

Driving Industry Innovation

Every single process revolves around information which comes in various formats from all different sources which must be gathered and analyzed timely. Time to decision is critical. Easy access to information, contextually provided at the right time to the right person is crucial.

Insurance is a paper and information-heavy process.

Hundreds of documents and thousands of data points must be collected every time a policyholder makes a change, filing a claim, and a client service representative is working to close it. In an industry where speed equals success, insurers are looking for technology to make the process more efficient, cost effective, and safe.

Driving Industry Innovation

Each process revolves around information that comes from multiple sources and formats; for example, it can come from internal sources, vendors, and third-party administrators. Data and information drive business decisions, which is why time becomes critical.

INSURANCE

MODERNIZATION

INSURANCE MODERNIZATION

Solutions for Property & Casualty

Solutions for Life & Annuity

Solutions for Payers

Solutions for The Back Office

PROPERTY

& CASUALTY

Guidewire® PolicyCenter® Integration

The OnBase integration for Guidewire PolicyCenter allows users to access content in context surfaced directly from any screen within Guidewire. When information is captured into OnBase it is immediately available from Guidewire with an associated activity record. The OnBase integration provides the ability to manage the creation of policy content, manage adhoc correspondence and package related information, then store directly into OnBase and made available for distribution to fax, email, network printer or FTP site, Portal or website.

New Business Processing

OnBase automates the capture of new submissions and many of the manual, repetitive steps required to process new business. Applications and supporting documents are gathered from the point of receipt, regardless of file format or origination. OnBase automatically assesses the completeness of the submission and requests the missing required documentation (MVRs, credit reports, D&Bs, etc.). Accelerated receipt of information helps both finance and underwriting departments increased positive cash flow and improved service.

Guidewire® ClaimCenter® Integration

With the OnBase Integration for Guidewire ClaimCenter, adjusters have instant access to documents such as claims photos, first notice of loss and medical documentation allowing them to investigate and settle a claim. OnBase can automatically generating acknowledgement letters and requests for additional information increasing efficiency. Guidewire also can initiate processes using OnBase Workflow, assigning internal tasks and alerting third parties that perform critical activities, including subrogation, litigation and medical review.

Claims Case Management

Information typically is gathered from various sources making a considerable amount of the claims process task related. OnBase Claims Case Management allows adjusters to manage complex situations that must be evaluated over a period of time and provides one interface to manage both structured and unstructured information in one view for easier collaboration with both internal and external parties.

Guidewire® BillingCenteR® Integration

The OnBase integration for Guidewire BillingCenter provides users with access to related policy documents directly from the Guidewire interface, without navigating to the documents tab. Results include exceptional customer care, specifically as it relates to the policy premium, current enforce details and cancellation or reinstatement payment monitoring. Accounting operations become more effective with improved access to invoices, commission statements, cancellations and reinstatement notices directly from Guidewire BillingCenter.

LIFE

& ANNUITY

Underwriting Workbench

The OnBase Life Underwriting Workbench incorporates advanced case management capabilities to automate and streamline the capture of new business applications, underwriting submission preparation, evidence ordering and critical correspondence during the review process including automated message sequencing.

Evidence Management

The OnBase Evidence Management solution distributes B2B transactional evidence directly to diagnostic vendors, clinics and financial institutions through an automated process within the new business process. As new submissions are received the evidence can automatically be ordered on an adhoc basis by underwriting or by automated means based upon business rules.

Facultative Reinsurance

The OnBase Reinsurance MarketPlace solution allows insurers to effectively manage the facultative reinsurance process of negotiation and placement. The solution automatically creates reinsurance packets based on templates and business rules and executes automated distribution via FTP/SFTP, etc. The solution tracks the back-and-forth communication, selected and discarded offers and provides a dashboard view of the status of all policies that are in the process of being reinsured and who is managing them, allowing for aggregated reporting.

Contract Packaging

OnBase document packaging minimizes the effort of packaging contracts in a very specific manner based upon regional requirements. OnBase provides the ability to create a single PDF document (package) from pre-configured templates, giving users the ability to combine, delete/reorder pages and/or change the output based on need. The solution creates a cover page with brand/logo, then adds the created contract, original application and supporting evidence used to make underwriting decisions.

Claims Processing

OnBase can automate the initiation of the claims process from paper, fax, email, eNotice, phone call and then streamlining the assignment of work, generation of letters, investigation and settlement. Death claims, although very straightforward, are extremely time consuming for life insurers. OnBase provides the ability to integrate with LifePro®, and other claims systems and other core systems providing examiners one single interface to both solutions.

Contract Management

Employer contracts for group insurance dominate workloads in the Group segment, and significant manual processing is required to manage the multi-faceted contracts. The OnBase Contract Management solution allows organizations to create a single case to encompass all contextual information around the employer, the current contract and renewal conditions. The solution also tracks revisions and negotiations, and dashboard reports provide increased visibility on contract status and patterns to improve the process at renewal.

New Client Onboarding

OnBase reduces new account opening processing times and enables financial institutions to transform paper-based files into electronic forms available via intranet, internet and home banking platforms. The OnBase Client Onboarding solution eliminates many time-consuming, paper-based tasks; reduces costs and demands of new client processing; and enables staff to focus on higher-value initiatives within the process.

Licensing & Contracting

Initial onboarding may include contracts, training, licensing, appointments and more – many of which must also be revisited annually. With the OnBase Licensing & Contracting solution, organizations manage these processes with automated business process management tools. Notifications and timers keep insurers on top of the varied and numerous dates and renewal cycles.

Anti-Money Laundering Investigative Case Management

The OnBase Anti-Money Laundering Investigative Case Management solution provides ability to report, track, monitor, action, escalate and report suspicious activity during financial transactions with the organization. Users throughout the organization can report suspicious transactions via self-service report forms. The solution can also interface with third party tools to automatically detect potentially fraudulent transactions. The case is intended to provide a 360-degree view of the client, transaction, and other key information.

Governance, Risk & Compliance

The OnBase Governance, Risk & Compliance solution provides insurers with the ability to keep a regulatory inventory system and is used to track and monitor legislative requirements, impact to each jurisdiction within business operations and what actions have to be implemented to comply with such regulation.. Also provides risk rating to give visibility to senior leaders of the potential liability for non-compliance. Monitoring tools give real time compliance reporting to assure auditors that all mechanisms are in place to ensure the company is following regulation.

Market Conduct

The OnBase Market Conduct solution provides for tracking and monitoring of all complaints, investigations and review of all marketing materials used by distribution channel to ensure it is compliant with legal and regulatory requirements. Compliance for sales (Market Conduct) manages compliance for sales agents (sales practices, product disclosure). Investigations (Ombudsman Office) manages escalated complaints from clients. Early Marketing and training material monitoring for legislative requirements.

Code of Conduct & Ethics Training

The compliance department can load content (documents, videos, etc.) into OnBase and distribute the information and policies throughout the organization. When a new policy or test becomes available the content is pushed to that user or group for review and acknowledgement. (Acknowledgement is through credentials.) The compliance department can test users on the material reviewed simply by adding an exam to the reading group. OnBase provides dashboards to quickly identify gaps in training and/or compliance policies.

Customer Complaint Management

The OnBase Customer Complaint Management solution manages case files that have received client complaints. The solution provides multi-channel capture of complaints followed by the ability to record, log and track the deposition of the complaint, how and when it was managed and what resolution was given. The OnBase Customer Complaint solution provides intuitive reporting to view average case completion time, cases by type, workloads and more.

PAYERS

Health Insurance

Member Appeals & Grievances

OnBase automatically classifies and prioritizes oncoming work based on if an appeal is life threatening (medication correction or medical treatment required) or monetary a (adjustment to deductible). OnBase routes work bases on the type of appeal and corresponding service level agreement, reviewer, required approvals. OnBase generates initial acknowledgement letters often required for compliance, determination letters once a decision is reached, and payment authorization notices when financial component is included in the decision.

Open Enrollment

The OnBase Open Enrollment Solution empowers mobile workers to make confident business decisions by offering them the opportunity to interact and capture critical information whether connected to a network or not. Mobile personnel complete electronic version of regulated form, which are equipped with auto fill functionality for repeating fields to reduce entry times and errors. After data collection is complete, the forms are displayed to the client and representative for review signatures.

Provider Appeals

With appeals coming in from a variety of sources -paper, fax, email, portals, and the phone- it’s difficult to build compliance into processes. With OnBase Provider Appeals, every appeal is systematically tracked from receipt through determination, regardless of the source. Knowing an appeal’s status at every step in the process is critical. The OnBase Provide Appeals solutions provide dashboards that show real-time process details for inventory, productivity, work in process, and more.

Provider Contract Agreements

With OnBase, you capture contracts and supporting data and documents; provide legal personnel with a complete view of all contract-related information; automatically route contracts for review and approval; digitally sign; support compliance with a full audit trail; and send automatic notifications of impending expirations and auto-renewals. Equip managers and legal departments with full visibility into the contract process, from a history of interactions with data to a clear view of current work and upcoming obligations.

Provider Credentialing

With OnBase, you collect, verify and track all information required to effectively manage the provider credentialing process – helping ensure that credentials are up-to-date and that physicians are not performing work outside their scope of education and expertise. OnBase offers a single, secure source for provider information, enabling staff to easily view a list of all outstanding credentialing tasks, activities and work items in one central location.

Provider Network Management

Provider Network Management for OnBase helps payers effectively and efficiently manage their networks, as well as accurately configure individual contracts to avoid fees and compliance issues. OnBase has functionality that includes identifying and recruiting providers for inclusion into a network that can then deliver care to members of that health plan or those enrolled under a specific product offered by the health plan. This may include consideration of specialty, geographic location or other demographics.

Claims Adjudication

OnBase helps to streamline a claims lifecycle, ensuring that all the proper people touch the document at the correct time. With pended claims, the workflow process does the routing and subsequent data entry that would otherwise be done manually by insurance workers. After the pended claims process is complete, OnBase then sends a letter to the member describing the outcome of their claim review. OnBase confirms that these letters are sent at the correct time, ensuring that the communication between payer and member are consistent.

Claims Processing

OnBase confirms that these letters are sent at the correct time, ensuring that the communication between payer and member are consistent.OnBase can verify if coverage is in place and if the policy is active before distributing a claim to an assigned adjudicator by integrating with core claims applications. With OnBase’s advanced capture capabilities, claims forms may be identified and classified (automatically noting duplicate claims), extracting line item data from claims forms such as UB52, UB04 and CMS1500, and converting the values to an XML data stream. This EDI file can be imported into core applications eliminating data entry, improving quality and reducing processing times.

Utilization Management/Medical Review

Medical Review for OnBase simplifies the physician review process, making it quicker and easier for registered physicians to provide claim determinations for their payers. OnBase uses workflow to create an automated approval process and helps manage documents electronically in a secure central repository, ensuring that the right medical professionals review the correct claims, which means that their payers receive their complete information.

PROPERTY

& CASUALTY

Guidewire® PolicyCenter® Integration

The OnBase integration for Guidewire PolicyCenter allows users to access content in context surfaced directly from any screen within Guidewire. When information is captured into OnBase it is immediately available from Guidewire with an associated activity record. The OnBase integration provides the ability to manage the creation of policy content, manage adhoc correspondence and package related information, then store directly into OnBase and made available for distribution to fax, email, network printer or FTP site, Portal or website.

New Business Processing

OnBase automates the capture of new submissions and many of the manual, repetitive steps required to process new business. Applications and supporting documents are gathered from the point of receipt, regardless of file format or origination. OnBase automatically assesses the completeness of the submission and requests the missing required documentation (MVRs, credit reports, D&Bs, etc.). Accelerated receipt of information helps both finance and underwriting departments increased positive cash flow and improved service.

Guidewire® ClaimCenter® Integration

With the OnBase Integration for Guidewire ClaimCenter, adjusters have instant access to documents such as claims photos, first notice of loss and medical documentation allowing them to investigate and settle a claim. OnBase can automatically generating acknowledgement letters and requests for additional information increasing efficiency. Guidewire also can initiate processes using OnBase Workflow, assigning internal tasks and alerting third parties that perform critical activities, including subrogation, litigation and medical review.

Claims Case Management

Information typically is gathered from various sources making a considerable amount of the claims process task related. OnBase Claims Case Management allows adjusters to manage complex situations that must be evaluated over a period of time and provides one interface to manage both structured and unstructured information in one view for easier collaboration with both internal and external parties.

Guidewire® BillingCenteR® Integration

The OnBase integration for Guidewire BillingCenter provides users with access to related policy documents directly from the Guidewire interface, without navigating to the documents tab. Results include exceptional customer care, specifically as it relates to the policy premium, current enforce details and cancellation or reinstatement payment monitoring. Accounting operations become more effective with improved access to invoices, commission statements, cancellations and reinstatement notices directly from Guidewire BillingCenter.

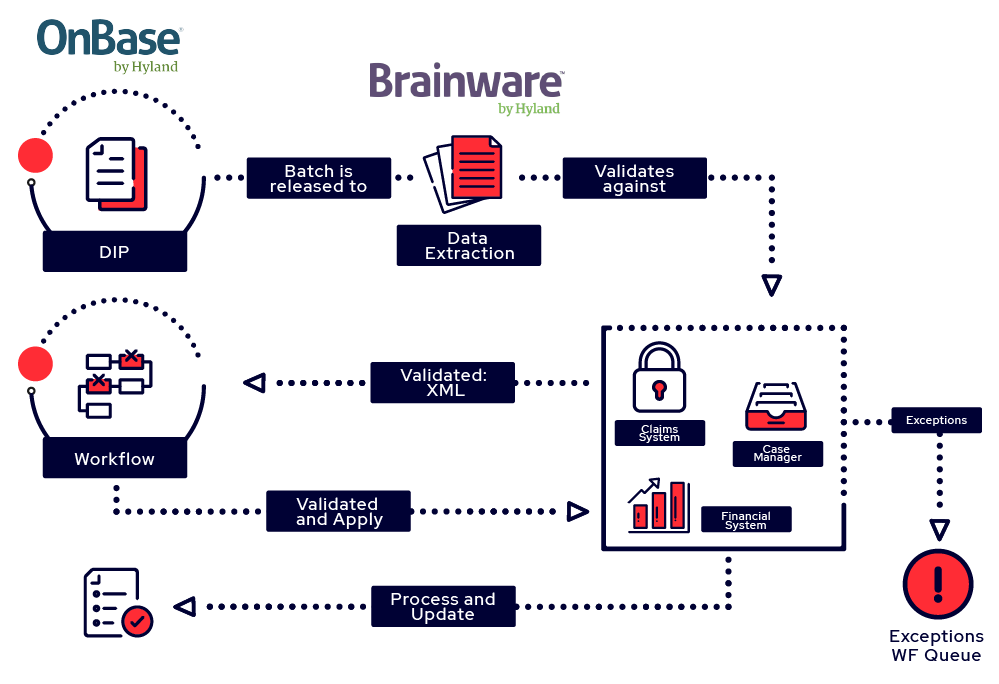

Brainware Capture for Life Insurance

Reduce Paper & Automate the Evaluation Processes

LIFE

& ANNUITY

Underwriting Workbench

The OnBase Life Underwriting Workbench incorporates advanced case management capabilities to automate and streamline the capture of new business applications, underwriting submission preparation, evidence ordering and critical correspondence during the review process including automated message sequencing.

Evidence Management

The OnBase Evidence Management solution distributes B2B transactional evidence directly to diagnostic vendors, clinics and financial institutions through an automated process within the new business process. As new submissions are received the evidence can automatically be ordered on an adhoc basis by underwriting or by automated means based upon business rules.

Facultative Reinsurance

The OnBase Reinsurance MarketPlace solution allows insurers to effectively manage the facultative reinsurance process of negotiation and placement. The solution automatically creates reinsurance packets based on templates and business rules and executes automated distribution via FTP/SFTP, etc. The solution tracks the back-and-forth communication, selected and discarded offers and provides a dashboard view of the status of all policies that are in the process of being reinsured and who is managing them, allowing for aggregated reporting.

Contract Packaging

OnBase document packaging minimizes the effort of packaging contracts in a very specific manner based upon regional requirements. OnBase provides the ability to create a single PDF document (package) from pre-configured templates, giving users the ability to combine, delete/reorder pages and/or change the output based on need. The solution creates a cover page with brand/logo, then adds the created contract, original application and supporting evidence used to make underwriting decisions.

Claims Processing

OnBase can automate the initiation of the claims process from paper, fax, email, eNotice, phone call and then streamlining the assignment of work, generation of letters, investigation and settlement. Death claims, although very straightforward, are extremely time consuming for life insurers. OnBase provides the ability to integrate with LifePro®, and other claims systems and other core systems providing examiners one single interface to both solutions.

Contract Management

Employer contracts for group insurance dominate workloads in the Group segment, and significant manual processing is required to manage the multi-faceted contracts. The OnBase Contract Management solution allows organizations to create a single case to encompass all contextual information around the employer, the current contract and renewal conditions. The solution also tracks revisions and negotiations, and dashboard reports provide increased visibility on contract status and patterns to improve the process at renewal.

New Client Onboarding

OnBase reduces new account opening processing times and enables financial institutions to transform paper-based files into electronic forms available via intranet, internet and home banking platforms. The OnBase Client Onboarding solution eliminates many time-consuming, paper-based tasks; reduces costs and demands of new client processing; and enables staff to focus on higher-value initiatives within the process.

Licensing & Contracting

Initial onboarding may include contracts, training, licensing, appointments and more – many of which must also be revisited annually. With the OnBase Licensing & Contracting solution, organizations manage these processes with automated business process management tools. Notifications and timers keep insurers on top of the varied and numerous dates and renewal cycles.

Anti-Money Laundering Investigative Case Management

The OnBase Anti-Money Laundering Investigative Case Management solution provides ability to report, track, monitor, action, escalate and report suspicious activity during financial transactions with the organization. Users throughout the organization can report suspicious transactions via self-service report forms. The solution can also interface with third party tools to automatically detect potentially fraudulent transactions. The case is intended to provide a 360-degree view of the client, transaction, and other key information.

Governance, Risk & Compliance

The OnBase Governance, Risk & Compliance solution provides insurers with the ability to keep a regulatory inventory system and is used to track and monitor legislative requirements, impact to each jurisdiction within business operations and what actions have to be implemented to comply with such regulation.. Also provides risk rating to give visibility to senior leaders of the potential liability for non-compliance. Monitoring tools give real time compliance reporting to assure auditors that all mechanisms are in place to ensure the company is following regulation.

Market Conduct

The OnBase Market Conduct solution provides for tracking and monitoring of all complaints, investigations and review of all marketing materials used by distribution channel to ensure it is compliant with legal and regulatory requirements. Compliance for sales (Market Conduct) manages compliance for sales agents (sales practices, product disclosure). Investigations (Ombudsman Office) manages escalated complaints from clients. Early Marketing and training material monitoring for legislative requirements.

Code of Conduct & Ethics Training

The compliance department can load content (documents, videos, etc.) into OnBase and distribute the information and policies throughout the organization. When a new policy or test becomes available the content is pushed to that user or group for review and acknowledgement. (Acknowledgement is through credentials.) The compliance department can test users on the material reviewed simply by adding an exam to the reading group. OnBase provides dashboards to quickly identify gaps in training and/or compliance policies.

Customer Complaint Management

The OnBase Customer Complaint Management solution manages case files that have received client complaints. The solution provides multi-channel capture of complaints followed by the ability to record, log and track the deposition of the complaint, how and when it was managed and what resolution was given. The OnBase Customer Complaint solution provides intuitive reporting to view average case completion time, cases by type, workloads and more.

THE BACK

OFFICE

Corporate Legal leverages the OnBase solutions to manage the process surrounding their contracts and other legal actions. The solution provides legal with the ability to effectively conduct contract management within OnBase allowing for revision control, distribution of and collaboration around negotiation and other pertinent processes. Additionally, Corporate Legal can benefit by use of the On-Base Insurance solution by having access to all pertinent corporate records related to policy, claims, vendors, and agents & brokers.

OnBase electronically stores and instantly distributed applications and resumes to the right staff, assisting with scheduling interviews and sending correspondence. With OnBase there is visibility into the entire process, from recruitment to offer letter. Hiring managers can easily access and review information, get a better understanding of open positions, the applicant under consideration, and where recruitment stands in the process. OnBase ensures candidates’ documentation is not lost in the process.

OnBase gives human resources personnel the tools they need to better manage the onboarding process and provide new employees with as smooth a transition as possible. OnBase enables staff to easily track the entire onboarding process and monitor tasks across departments. Through automation, increased visibility and centralized management, OnBase supports more effective onboarding. This can also be applied to off boarding, helping to ensure that each step is followed and ensuring compliance and security.

OnBase enables HR departments to better manage employee files, equipping personnel with secure, instant access to information. With OnBase, organizations store employee documents electronically in one central secure location supporting compliance initiatives, whether they’re scanned, faxed or emailed. Because OnBase connects with an organization’s human resources information system (HRIS), personnel retrieve employee documents and data without leaving familiar interfaces.

OnBase simplifies records management. With a structured retention policy based on your requirements, OnBase establishes consistent, automated processes for retaining important records and destroying expired ones. When a document is stored into the OnBase system, it is automatically placed under the correct retention plan based on its document type, with an un-editable data trail, securely protected throughout its lifespan, and automatically destroyed at the appropriate time.

OnBase standardizes the vendor request and sourcing process including access to demographics, contacts, points of service, and supporting documents like bank verifications and risk assessments. OnBase provides users access to vendor contracts; track key business terms and proactively manage expirations and renewals and generate vendor scorecards and reports of vendor performance. Users can record feedback/incidents and complete vendor evaluations in order to supports decisions to maintain a relationship with a specific vendor.

The OnBase Purchase Requisition solution streamlines the purchasing process by routing information to managers and the procurement team for action. Because OnBase integrates with ERP systems– including SAP®, Lawson®, PeopleSoft®, Oracle, JD Edwards and Dynamics – all purchasing data is automatically entered for the creation of purchase orders. In addition, the OnBase Purchase Requisition solution allows users to store electronic copies of all documents for access at any time directly from your company’s ERP.

With OnBase, invoices are captured electronically and delivered to the appropriate people for review, approval and coding. By electronically managing the documents and information that drive AP processes, organizations maximize the benefits of fast and accurate invoice processing while improving vendor relationships and realizing early-payment discounts.

PAYERS

Health Insurance

Member Appeals & Grievances

OnBase automatically classifies and prioritizes oncoming work based on if an appeal is life threatening (medication correction or medical treatment required) or monetary a (adjustment to deductible). OnBase routes work bases on the type of appeal and corresponding service level agreement, reviewer, required approvals. OnBase generates initial acknowledgement letters often required for compliance, determination letters once a decision is reached, and payment authorization notices when financial component is included in the decision.

Open Enrollment

The OnBase Open Enrollment Solution empowers mobile workers to make confident business decisions by offering them the opportunity to interact and capture critical information whether connected to a network or not. Mobile personnel complete electronic version of regulated form, which are equipped with auto fill functionality for repeating fields to reduce entry times and errors. After data collection is complete, the forms are displayed to the client and representative for review signatures.

Provider Appeals

With appeals coming in from a variety of sources -paper, fax, email, portals, and the phone- it’s difficult to build compliance into processes. With OnBase Provider Appeals, every appeal is systematically tracked from receipt through determination, regardless of the source. Knowing an appeal’s status at every step in the process is critical. The OnBase Provide Appeals solutions provide dashboards that show real-time process details for inventory, productivity, work in process, and more.

Provider Contract Agreements

With OnBase, you capture contracts and supporting data and documents; provide legal personnel with a complete view of all contract-related information; automatically route contracts for review and approval; digitally sign; support compliance with a full audit trail; and send automatic notifications of impending expirations and auto-renewals. Equip managers and legal departments with full visibility into the contract process, from a history of interactions with data to a clear view of current work and upcoming obligations.

Provider Credentialing

With OnBase, you collect, verify and track all information required to effectively manage the provider credentialing process – helping ensure that credentials are up-to-date and that physicians are not performing work outside their scope of education and expertise. OnBase offers a single, secure source for provider information, enabling staff to easily view a list of all outstanding credentialing tasks, activities and work items in one central location.

Provider Network Management

Provider Network Management for OnBase helps payers effectively and efficiently manage their networks, as well as accurately configure individual contracts to avoid fees and compliance issues. OnBase has functionality that includes identifying and recruiting providers for inclusion into a network that can then deliver care to members of that health plan or those enrolled under a specific product offered by the health plan. This may include consideration of specialty, geographic location or other demographics.

Claims Adjudication

OnBase helps to streamline a claims lifecycle, ensuring that all the proper people touch the document at the correct time. With pended claims, the workflow process does the routing and subsequent data entry that would otherwise be done manually by insurance workers. After the pended claims process is complete, OnBase then sends a letter to the member describing the outcome of their claim review. OnBase confirms that these letters are sent at the correct time, ensuring that the communication between payer and member are consistent.

Claims Processing

OnBase confirms that these letters are sent at the correct time, ensuring that the communication between payer and member are consistent.OnBase can verify if coverage is in place and if the policy is active before distributing a claim to an assigned adjudicator by integrating with core claims applications. With OnBase’s advanced capture capabilities, claims forms may be identified and classified (automatically noting duplicate claims), extracting line item data from claims forms such as UB52, UB04 and CMS1500, and converting the values to an XML data stream. This EDI file can be imported into core applications eliminating data entry, improving quality and reducing processing times.

Utilization Management/Medical Review

Medical Review for OnBase simplifies the physician review process, making it quicker and easier for registered physicians to provide claim determinations for their payers. OnBase uses workflow to create an automated approval process and helps manage documents electronically in a secure central repository, ensuring that the right medical professionals review the correct claims, which means that their payers receive their complete information.

THE BACK

OFFICE

Corporate Legal leverages the OnBase solutions to manage the process surrounding their contracts and other legal actions. The solution provides legal with the ability to effectively conduct contract management within OnBase allowing for revision control, distribution of and collaboration around negotiation and other pertinent processes. Additionally, Corporate Legal can benefit by use of the On-Base Insurance solution by having access to all pertinent corporate records related to policy, claims, vendors, and agents & brokers.

OnBase electronically stores and instantly distributed applications and resumes to the right staff, assisting with scheduling interviews and sending correspondence. With OnBase there is visibility into the entire process, from recruitment to offer letter. Hiring managers can easily access and review information, get a better understanding of open positions, the applicant under consideration, and where recruitment stands in the process. OnBase ensures candidates’ documentation is not lost in the process.

OnBase gives human resources personnel the tools they need to better manage the onboarding process and provide new employees with as smooth a transition as possible. OnBase enables staff to easily track the entire onboarding process and monitor tasks across departments. Through automation, increased visibility and centralized management, OnBase supports more effective onboarding. This can also be applied to off boarding, helping to ensure that each step is followed and ensuring compliance and security.

OnBase enables HR departments to better manage employee files, equipping personnel with secure, instant access to information. With OnBase, organizations store employee documents electronically in one central secure location supporting compliance initiatives, whether they’re scanned, faxed or emailed. Because OnBase connects with an organization’s human resources information system (HRIS), personnel retrieve employee documents and data without leaving familiar interfaces.

OnBase simplifies records management. With a structured retention policy based on your requirements, OnBase establishes consistent, automated processes for retaining important records and destroying expired ones. When a document is stored into the OnBase system, it is automatically placed under the correct retention plan based on its document type, with an un-editable data trail, securely protected throughout its lifespan, and automatically destroyed at the appropriate time.

OnBase standardizes the vendor request and sourcing process including access to demographics, contacts, points of service, and supporting documents like bank verifications and risk assessments. OnBase provides users access to vendor contracts; track key business terms and proactively manage expirations and renewals and generate vendor scorecards and reports of vendor performance. Users can record feedback/incidents and complete vendor evaluations in order to supports decisions to maintain a relationship with a specific vendor.

The OnBase Purchase Requisition solution streamlines the purchasing process by routing information to managers and the procurement team for action. Because OnBase integrates with ERP systems– including SAP®, Lawson®, PeopleSoft®, Oracle, JD Edwards and Dynamics – all purchasing data is automatically entered for the creation of purchase orders. In addition, the OnBase Purchase Requisition solution allows users to store electronic copies of all documents for access at any time directly from your company’s ERP.

With OnBase, invoices are captured electronically and delivered to the appropriate people for review, approval and coding. By electronically managing the documents and information that drive AP processes, organizations maximize the benefits of fast and accurate invoice processing while improving vendor relationships and realizing early-payment discounts.

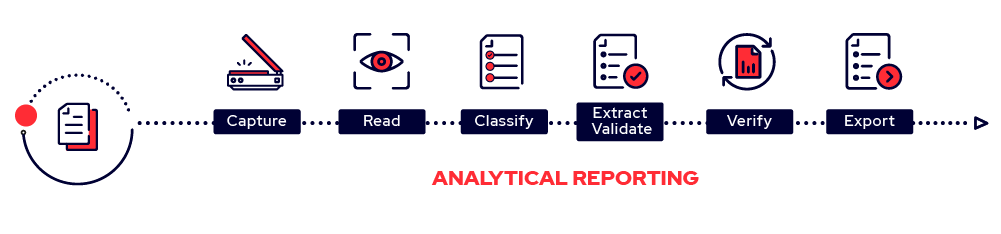

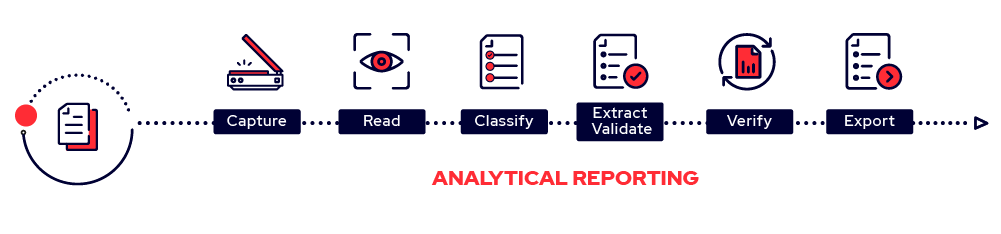

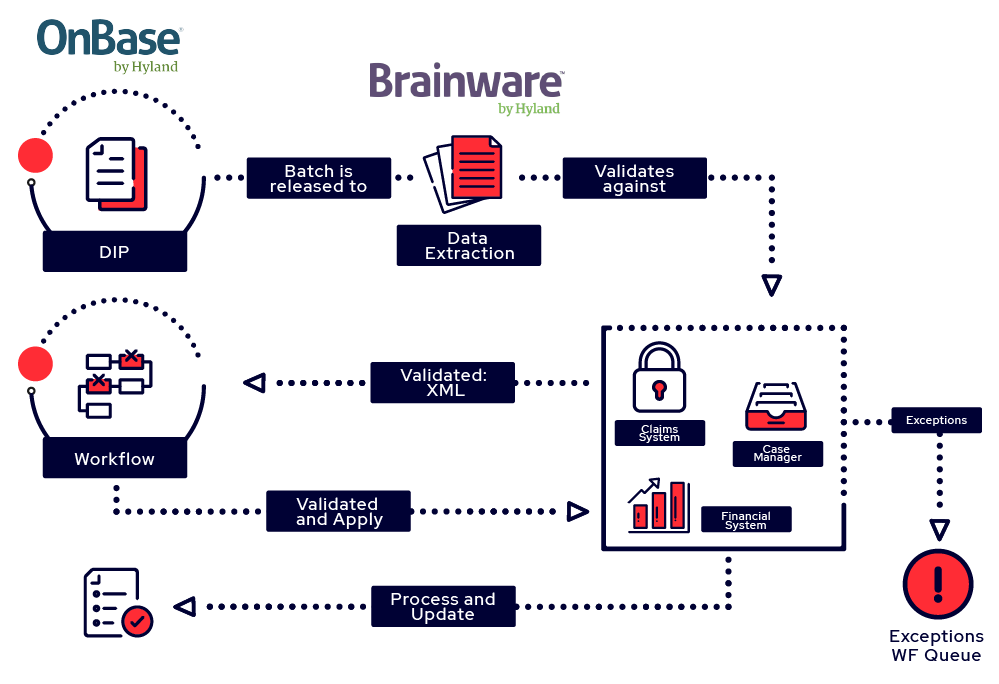

Intelligent Capture

FOR INSURANCE

It enables insurers to significantly reduce the number of human touch points often required to process a change or to close a claim. Using industry leading OCR and intelligent capture technology, Brainware Capture virtually eliminates the need to classify documents manually and hand-key data from even the most complex, diverse document types, transforming the process into a fast and effective automated routine.

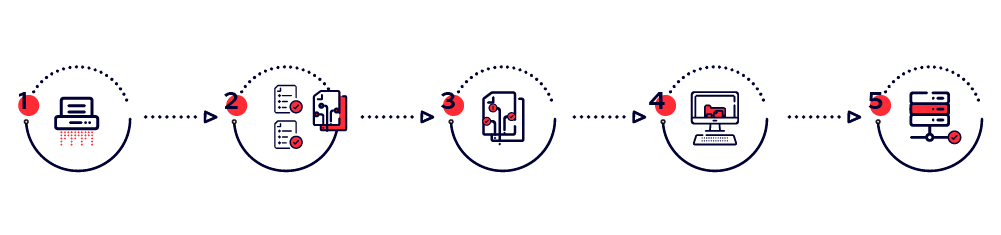

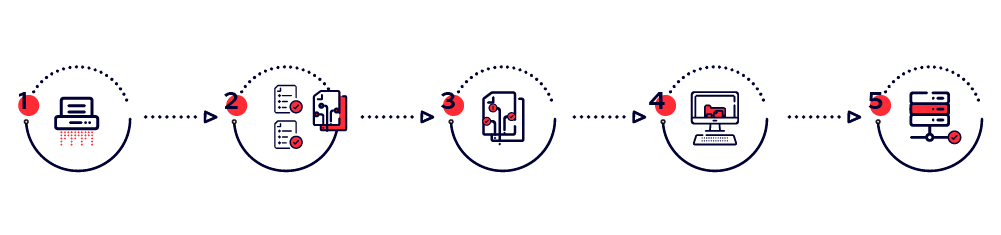

Unlike other integrated products that require significant IT resources, Brainware’s technology integrates effortlessly with host applications. Brainware empowers insurers with increased control over the speed and accuracy of the document and data collection process, resulting in risk reduction, cost savings and improved customer satisfaction. 1. Client documents are ingested into the intelligent capture solution either through scanning or electronic import

1. Client documents are ingested into the intelligent capture solution either through scanning or electronic import

2. Documents, such as Beneficiary Change, Address Change, Post Issue, Death Claims and Surrender Requests are identified and classified into their appropriate document categories and then prepped for data extraction

3. Important data elements, like insured’s name, addresses and dates of birth, as well as policy data, are extracted and validated.

4. The sorted data files are integrated into a cohesive document list that can easily be passed on to the robotic process automation systems or core line of business applications for Straight thru processing or onto the OnBase Exception Handling Workflow, providing greater transparency into data and missing documentation.

5. If desired, the document and data set can be sent to your integrated ECM system for ongoing business workflow processes and retention.

Brainware Intelligent Capture will enable life insurers to transform the time-intensive task of manually processing documents into a fast and effective automated routine. Coupled with OnBase’s leading workflow and integration components this will enable insurers to leverage a higher degree of validation and automation with extracted output from Brainware.

Brainware Intelligent Capture works hand in hand with OnBase Workflow and OnBase integration capabilities to extend capture to provide elements of straight through processing, enabling a high degree of quality and throughput on several of the manual processes that currently exist within Life Insurance business processes today.

INTELLIGENT CAPTURE

FOR INSURANCE

It enables insurers to significantly reduce the number of human touch points often required to process a change or to close a claim. Using industry leading OCR and intelligent capture technology, Brainware Capture virtually eliminates the need to classify documents manually and hand-key data from even the most complex, diverse document types, transforming the process into a fast and effective automated routine.

Unlike other integrated products that require significant IT resources, Brainware’s technology integrates effortlessly with host applications. Brainware empowers insurers with increased control over the speed and accuracy of the document and data collection process, resulting in risk reduction, cost savings and improved customer satisfaction. 1. Client documents are ingested into the intelligent capture solution either through scanning or electronic import

1. Client documents are ingested into the intelligent capture solution either through scanning or electronic import

2. Documents, such as Beneficiary Change, Address Change, Post Issue, Death Claims and Surrender Requests are identified and classified into their appropriate document categories and then prepped for data extraction

3. Important data elements, like insured’s name, addresses and dates of birth, as well as policy data, are extracted and validated.

4. The sorted data files are integrated into a cohesive document list that can easily be passed on to the robotic process automation systems or core line of business applications for Straight thru processing or onto the OnBase Exception Handling Workflow, providing greater transparency into data and missing documentation.

5. If desired, the document and data set can be sent to your integrated ECM system for ongoing business workflow processes and retention.

Brainware Intelligent Capture will enable life insurers to transform the time-intensive task of manually processing documents into a fast and effective automated routine. Coupled with OnBase’s leading workflow and integration components this will enable insurers to leverage a higher degree of validation and automation with extracted output from Brainware.

Brainware Intelligent Capture works hand in hand with OnBase Workflow and OnBase integration capabilities to extend capture to provide elements of straight through processing, enabling a high degree of quality and throughput on several of the manual processes that currently exist within Life Insurance business processes today.

REDUCE PAPER & AUTOMATE

THE EVALUATION PROCESSES

REDUCE PAPER & AUTOMATE

THE EVALUATION PROCESSES

The OnBase New Business and Underwriting Solution can help insurers provide a digital approach to selling their insurance products thus eliminating the need for paper by using an electronic application form for gathering information from customers while they are at an agent or branch office.

The OnBase New Business & Underwriting Solution for Commercial Property, Builders Risk & Surety Bonds also includes automated and semi-automated workflow processes to route applications to the right person, create pre-filled template letters for customers, and create and manage reminders for follow-up requests. There are numerous factors that influence a decision to underwrite a Commercial Property or Builders Risk or Surety bond. Presenting all the information appropriate is critical to effectively evaluate the risk of the Builder or bondee including evaluation for capital, credit, capacity and character of the oblige and the contractor. Workflow also gives managers the ability to view their team’s workload, run reports, and provide application status to agents, brokers and customers. Applications which require no follow-up questions or additional information could be automatically processed and issued without human intervention.

The OnBase New Business & Underwriting Solution can be integrated with email, the insurers core line of business system and other key applications. The OnBase New Business & Underwriting Solution can also be integrated with web services for automatically requesting and receiving additional requests. The OnBase New Business & Underwriting Solution also has a tight integration with email including Outlook, Lotus Notes, Groupwise or Gmail which supports quickly capturing incoming emails and attachments, as well as outbound letters and other requests.

OnBase is a proven solution that is scalable to meet the needs of any insurance commercial business operation’s requirements but also all of their information management needs across all product lines from new business, client servicing to claims processing both internally and externally. The flexibility of the OnBase solution accommodates each insurance company’s specific business needs, even those outside of the traditional underwriting and claims areas. OnBase provides organizations the ability to run more efficiently and cost-effectively by streamlining processes across operations.

Using industry leading OCR and intelligent capture technology, Brainware Capture virtually eliminates the need to classify documents manually and hand-key data from even the most complex, diverse document types, transforming the process into a fast and effective automated routine.

DISCOVER

MORE!

CONSTRUCTION SOLUTIONS

GOVERNMENT SOLUTIONS